As I find myself relishing the golden years of retirement alongside my husband, enveloped in the cheerful bustle and boundless love that our extended family brings, I view our blessings through a lens of gratitude. Yet, amidst all the joy and laughter, the curiosity about life’s practical aspects finds a natural place too. One topic that often garners attention is, “What is the average net worth of retirees?”

The median net worth of U.S. households according to the Fed’s 2019 survey is $121,700. Interestingly, the net worth of households with seniors is significantly higher.

Grasping the average net worth of retirees is not merely about crunching numbers. It’s about painting a realistic picture of retirement lifestyle. It helps in revisiting our financial preparation for the golden years, tweaking plans if necessary, and creating an enriching retirement life.

Understanding how we stack up financially helps retirees like myself create a secure cushion and enables that comforting stream of income we need in these golden years. Plus, it’s mighty helpful when planning all those grandkid birthday extravaganzas!

What is Your Retirement Net Worth?

Retirement can feel like an extended vacation to some, a serene retreat. But, it can also unroll as a scene full of unknown emotions for others. We celebrate milestones, breathe in the joy of unhurried mornings, yet sometimes long for our old routines. It’s a unique journey, different for everyone, but filled with universal experiences.

Speaking of retirement is as much about emotions as it is about finances. Don’t get flustered when you come across the term ‘net worth.’ Simply put, your net worth is a financial snapshot, a picture of your economic health.

Take what you own (like that lovely house of yours, your reliable vehicle, money in the bank) – these are your assets. Now, consider what you owe (perhaps a bit left on the mortgage or some credit card bills?) – these are your liabilities. Your net worth? It’s simply your assets minus your liabilities.

In the context of retirement, knowing this monetary measure gives you a solid footing when mapping out those golden years. After all, retirement is about enjoying the fruits of your long years of labor.

Playing with Figures: Factors Shaping the Average Net Worth of Retirees

One beautiful thing about our system is the provision of social security benefits, designed as an economic safety net in our golden years. Aren’t these funds a comforting cushion? They’re monthly revenue streams that add to our retirement treasure chest, impacting our net worth.

It is important to remember that the exact amount of social security benefits each retiree receives can vary greatly depending on several factors, like previous earnings and age of retirement.

Another vital piece of the retirement puzzle are pension plans. Yes, those monthly checks that come from your years of hard work can significantly influence your average net worth after retiring.

The type of pension plan, be it a defined benefit plan or a defined contribution plan, could set the undertone for your post-retirement lifestyle and cushion your net worth.

While these are only two factors amongst many affecting your net worth, they bear significant influence. So, keep those in mind as we continue to explore the complex topic of the average net worth of retirees.

A Closer Look at the Average Net Worth of Retirees

You know, as my husband and I sit around our kitchen table, sometimes the conversation steers from shared family memories towards the numbers that reflect our collective retirement reality.

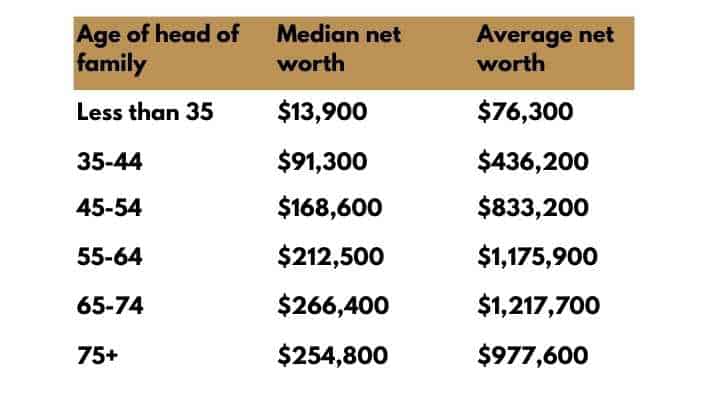

Wondering how we calculate the average net worth of Americans? The Federal Reserve Board steps in every three years with the Survey of Consumer Finances. This data-driven document illuminates our understanding of family incomes, net worth, and more.

Their latest report, issued in September 2020 based on 2019 data, tagged the overall average net worth of U.S. households at a staggering $748,800. Yes, you read that right! But bear in mind, this figure is skewed upward by the super wealthy.

To get a more relatable picture, let’s shift our focus to the median net worth, the ‘middle’ value that better represents the average individual. This figure stands at a more digestible $121,700 for U.S. households. Something more in tune with our reality, wouldn’t you agree?

For American families with heads aged between 55-64, the median net worth is around $212,500. As fellow card-carrying members of the 65-74 club, ours jumps up to $266,400. However, I notice, after 75, it shrinks slightly to $254,800.

These numbers aren’t just numbers. They sketch the diverse financial portraits of seniors like us, shaped by years of earnings, our frugal habits or splurges, and yes, those “too good to ignore” shares we once bought. Regardless of which age bracket retirees fall within, each tale is unique and captivating.

Unraveling the Financial Tapestry: A Look at Retiree Net Worth

When you picture the wealth of retirees, what comes to mind? A paid-off cozy home, perhaps? Or a swelling savings bank account maybe? Well, you’re right on track!

As we wade deeper into retirement, our own experiences and those heart-to-heart chats with our retiree friends have given me some interesting insights. You see, the most common assets among retirees often revolve around home equity, savings or checking accounts, and retirement accounts like 401(k)s and IRAs.

In our case, the warmth and memories encased within our fully paid-off family home form the core of our assets. Add to that the safety net of our retirement accounts that we’ve nurtured over the years.

While our family home and retirement accounts are comprised within our portfolio, your own asset mix may look quite different, painting a unique picture of your personal wealth journey in retirement.

These, dear friends, are more than merely financial figures; they represent our life’s work, sacrifices, and smart saving habits. They collectively contribute to our net worth and serve as a tangible reflection of our financial journey.

What Shapes a Retiree’s Net Worth

Consider those daily grocery runs. Do you notice how the cost of staples – bread, milk, eggs – has steadily crept up over time? This subtle yet consistent uptick in prices, dear friends, is inflation’s signature. Inflation is a subtle, steady rise in costs that can slowly eat into our savings and alter our cost of living. It’s an often overlooked factor, but it can nudge our net worth over time.

Then comes health – our most cherished asset. Let me tell you, from our experience, having a reliable healthcare plan isn’t just about ticking a box. It’s about having a safety net for those unforeseen health bumps on our retirement journey. Adequate preparation for likely healthcare costs is an integral part of our financial puzzle and significantly influences our net worth.

While these factors may not be the first things that come to mind when considering net worth, their impact on our retirement story is undeniable. The understanding they offer can guide us to negotiate the twists and turns of our retirement journey better.

Maximizing Wealth as Retired Seniors

Just as we once navigated our career paths, a hands-on approach is essential when it comes to our finances in retirement. Even in these golden years, effective money management and thoughtful budgeting strategies can make a significant difference.

Prioritizing our spending, distinguishing between needs and wants, and regularly reviewing our financial plans help keep our finances healthy and buoyant.

Did I ever tell you about the fascinating world of senior perks? Over time, my husband and I have discovered that being a senior has its silver linings. A world of discounts and benefits exclusively for us “golden-agers” await exploration. From discounts on meals and medical prescriptions to tax breaks and concessionary travel, these benefits can add up to some substantial savings!

The journey through retirement isn’t just about safeguarding our accumulated wealth; it’s also about maximizing it in smart ways. Each action goes a long way in safeguarding our financial wellbeing.

Financial Wisdom from Successful Retirees

Have I ever mentioned my friend, Martha? She’s someone we all can learn from when it comes to managing finances post-retirement. She astutely balanced her budget, planned her spending, and invested wisely, allowing her to comfortably stretch her retirement savings. She enjoys her retirement without any financial stress, proving that strategic financial management indeed pays off.

Now, George’s story is one that strikes a chord. Faced with financial uncertainty after retirement, he maximized his skills and explored options beyond traditional employment. He ventured into freelance work, picked up gig economy jobs, and even drummed up a small online business selling handmade crafts. His story is a testament to the fact that it’s never too late to reshape our financial landscape.

Moving Forward on Our Financial Journeys

As we navigate the sometimes turbid waters of retirement, every piece of practical advice counts. An understanding of our net worth, efficient financial planning, smart budgeting, and leveraging available benefits all add up to create a financially secure retirement.

Remember, our golden years aren’t meant for financial stress but to cherish life’s little pleasures.

Just as every story is unique, so is every financial journey. Regardless of where we stand financially, remember that the possibility of a financially secure retirement is real for every one of us.

Let’s stride forward with hope, determination, and the knowledge gleaned from our exploration of the average net worth of retirees. Together, let’s make these golden years truly golden.